does cash app report personal accounts to irs

Theres a lot of misinformation surrounding new IRS cash app rules that went into effect January 1 2022 and many users worry their transactions on apps like PayPal Zelle. If you receive more than 600 through cash apps you will receive a 1099-K in 2023 for transactions that occurred during the 2022 tax year.

Changes To Cash App Reporting Threshold Paypal Venmo More

Reporting Cash App Income.

. Log in to your Cash App Dashboard on web to download your forms. Cash App Support Tax Reporting for Cash App. Starting January 1 2022 if your Cash for Business account has 600 or more in gross sales in the 2022 tax year it will qualify for a Form 1099-K and Cash App is required to report it to the IRS.

Now cash apps are required to report payments totaling more than 600 for goods and services. However laws passed in March 2021 as part of the American Rescue Plan Act state that these apps now must report any business transactions that exceed 600 in a given year. Does Cash App report personal accounts to IRS.

Certain Cash App accounts will receive tax forms for the 2021 tax year. There Is NO 600 Tax Rule For Users Making Personal Payments On Cash App PayPal Others. Beginning this year Cash app networks are.

Money Apps Like Venmo Must Now Report 600 Transactions To The Irs

:max_bytes(150000):strip_icc()/CashAppTaxes-0f07d3b137894278bb44fb3f330bd7c3.jpeg)

What You Need To Know About Cash App Taxes

Cash App Bank Statement How To Get It

Does Cash App Report Personal Accounts To Irs New Rules Frugal Living Personal Finance Blog

Does The Irs Want To Tax Your Venmo Not Exactly

Can Cash App Be Traced Need To Know

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

Cash App Taxes Review 2022 Online Tax Software With No Fees Ever Cnet

.jpeg)

How To Do Your Cash App Taxes Coinledger

Irs Reports Transactions From Venmo Cash App Pay Pal More Wfmynews2 Com

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

Irs Cracking Down On Businesses Which Use Cash Apps Transactions Localmemphis Com

Ebay Or Etsy Sale Of 600 Now Prompt An Irs Form 1099 K Money

Does The Irs Want To Tax Your Venmo Not Exactly

New Irs Rule Requires Paypal Cashapp To Report Payments Over 600

Venmo Paypal And Cash App Will Now Have To Report Transactions Totaling More Than 600 To The Irs Daily Mail Online

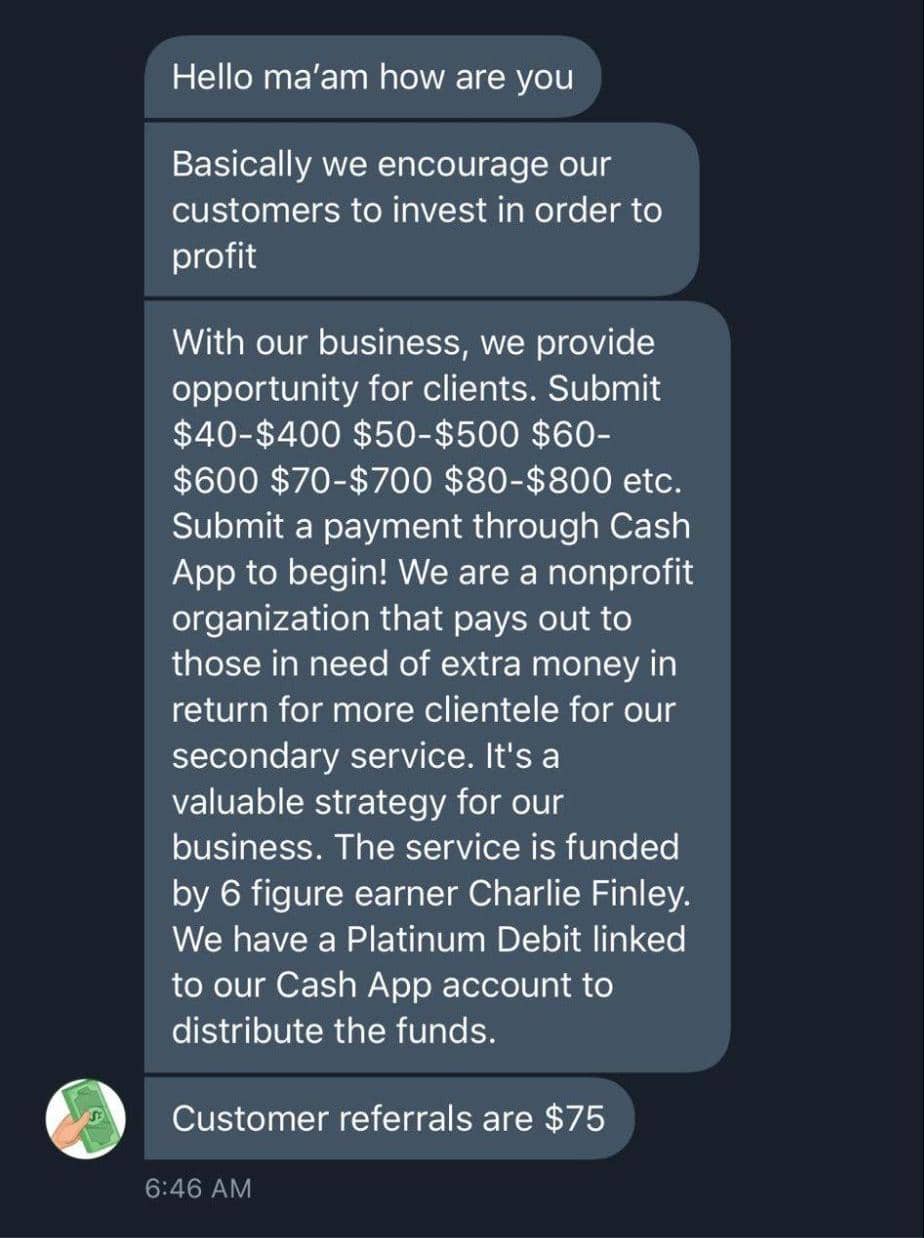

The 14 Cash App Scams You Didn T Know About Until Now Aura

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs